The Role of Technology in Facilitating and Preventing Housing Scams

August 16, 2023

Low-Income Housing Myths and Facts: Busting Common Misconceptions

October 10, 2023More landlords and tenants are turning to digital payment apps for rent, thanks to their convenience and speed. Apps like Venmo, PayPal, Zelle, and Cash App have made it easy to transfer money quickly and securely—at least in theory. While these apps offer plenty of advantages, they also come with unique risks, particularly for renters. At Section 8 Shield, we’ve researched the pros and cons of using payment apps for rent, along with essential safety tips to help you protect your money and information.

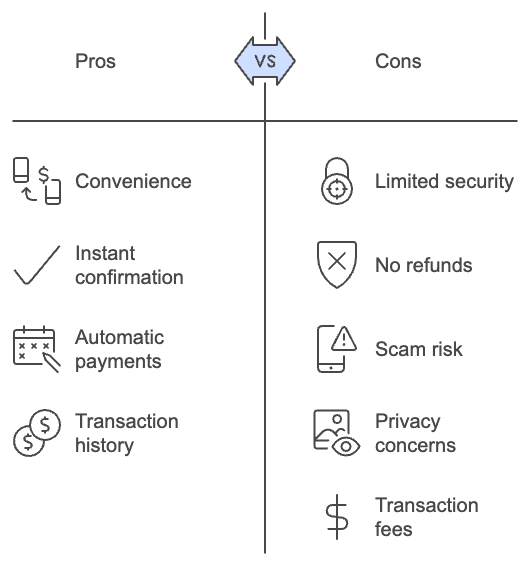

Pros of Paying Rent with Apps

Using payment apps to pay rent offers several advantages, especially for tenants who value speed and convenience. Here are some of the benefits:

1. Convenience

- What It Means: Payment apps allow you to pay rent from your phone or computer without the need to visit the bank, send a check, or meet your landlord in person.

- Benefit: For people with busy schedules or those who don’t have easy access to their landlord, this is a hassle-free option.

2. Instant Payment Confirmation

- What It Means: Many payment apps offer instant notifications when a transaction is completed, so you know immediately when your rent is paid.

- Benefit: Instant confirmation gives you peace of mind, especially close to the due date. You have proof of payment right in the app.

3. Automatic Payment Options

- What It Means: Some payment apps allow you to set up recurring payments, so your rent is automatically sent each month.

- Benefit: This can prevent late payments and help you stay on top of your rent obligations without having to remember due dates.

4. Transaction History and Tracking

- What It Means: Payment apps usually offer a record of all past transactions, making it easy to track your rent payments.

- Benefit: This transaction history can be helpful if there are disputes over payments, as you have a digital record to verify every payment made.

Cons of Paying Rent with Apps

Despite the advantages, there are significant risks to paying rent with apps. Here are some of the potential downsides:

1. Limited Security and Fraud Protection

- What It Means: Some payment apps, like Venmo and Zelle, don’t offer the same fraud protection as credit cards. Once you send money, it’s difficult—often impossible—to get it back if something goes wrong.

- Risk: If a scammer gains access to your landlord’s account or you mistakenly pay the wrong person, your money may be gone without any recourse.

2. No Refund or Chargeback Options

- What It Means: Unlike credit cards, which often allow chargebacks for fraudulent transactions, payment apps usually don’t offer a way to reverse a payment.

- Risk: If you accidentally overpay or if there’s a dispute with your landlord, you might not be able to get a refund easily.

3. Scam Vulnerability

- What It Means: Scammers exploit payment apps by creating fake landlord accounts or using stolen information to request payments.

- Risk: Some renters have reported cases where scammers impersonated landlords and asked for rent payments. Because payment apps are often linked to phone numbers or usernames, it can be easy to fall victim to impostors.

4. Privacy Concerns

- What It Means: Certain payment apps, like Venmo, may share transaction information unless privacy settings are updated.

- Risk: This can expose sensitive details about your rent payments to others, which could potentially be used by scammers to gather information on you.

5. Fees for Certain Transactions

- What It Means: Some apps charge fees for instant transfers or for payments funded by credit cards instead of bank accounts.

- Risk: If you or your landlord insists on instant payment, you may face additional fees each month. These fees can add up over time, making the convenience of payment apps more costly.

Safety Tips for Paying Rent with Apps

If you and your landlord agree to use a payment app, there are steps you can take to make it as safe as possible. Here are some best practices to protect your money and information.

| Confirm Payment Details with Your Landlord | Why It’s Important: Verifying your landlord’s username or payment information helps you avoid sending money to the wrong account. What to Do: Double-check the payment details with your landlord every few months, as scammers sometimes impersonate landlords or gain access to landlord accounts. |

| Use Privacy Settings | Why It’s Important: Certain apps, like Venmo, may display transaction details publicly unless you adjust your privacy settings. What to Do: Set your transactions to private to keep your rent payments hidden from others. This reduces the risk of scammers gathering information about your payment habits. |

| Use Two-Factor Authentication (2FA) | Why It’s Important: Two-factor authentication adds an extra layer of security to your account, making it harder for scammers to gain access. What to Do: Enable 2FA on your payment app, which typically requires a secondary code (like a text message code) each time you log in. |

| Avoid Using Public Wi-Fi for Transactions | Why It’s Important: Public Wi-Fi networks are less secure, making it easier for hackers to intercept your payment information. What to Do: Use a secure, private network (like your home Wi-Fi) to make payments. Avoid making rent payments when connected to public networks in coffee shops, libraries, or other shared spaces. |

| Keep Records of Each Transaction | Why It’s Important: A record of your rent payments can serve as proof if there’s ever a dispute with your landlord. What to Do: Save screenshots of each rent transaction and keep them in a designated folder. Some apps also allow you to download transaction histories for additional backup. |

| Verify the App’s Security Features | Why It’s Important: Some apps are more secure than others, with additional features to protect your information. What to Do: Look for apps that offer encryption, fraud protection, and secure logins. Apps like PayPal tend to have more robust security features compared to Venmo or Cash App, making them a safer choice for rent payments. |

| Discuss Alternatives with Your Landlord | Why It’s Important: If your landlord is open to other methods, it may be worth exploring more secure payment options. What to Do: Consider discussing bank transfers, checks, or even rent payment services that offer added protection and receipts. Some online rent payment platforms are specifically designed for rental transactions, which may include features to ensure security for both parties. |

Making Rent Payments Safely

Payment apps offer a lot of conveniences, but they also come with significant risks. While these apps can be a good option for rent payments, it’s essential to follow security tips, be cautious with payment details, and understand the potential downsides. At Section 8 Shield, we’re here to provide information and guidance to help renters navigate the rental process safely.

Consider the pros and cons, talk with your landlord about secure payment methods, and always prioritize security over convenience when handling rent payments. With the right precautions, you can protect your rent payments from the risks associated with payment apps and enjoy a more secure renting experience.