Caught in a Sublease Scam? Here’s How to Spot the Red Flags!

November 2, 2021

Facebook Rental and Housing Scams: How to Protect Yourself

December 17, 2021Rental scams are increasingly sophisticated, often involving payment platforms to manipulate renters out of their money. Here at Section 8 Shield, we’ve examined various scam tactics across the U.S., reviewed reader experiences, and analyzed how certain payment methods make scams easier for fraudsters. This guide will help you recognize risky payment requests and avoid falling victim to rental scams involving payment platforms.

How Payment Platforms Are Used in Rental Scams

Scammers often use specific payment methods because they make it difficult to track funds, cancel payments, or recover lost money. Here’s a closer look at how these platforms are manipulated:

- Untraceable Payments: Certain payment apps lack sufficient tracking features, making it challenging for law enforcement to follow the money trail.

- Instant Transfers: Many platforms allow instant transfers, making it impossible to reverse payments once they’re sent.

- Disguised Identity: Some platforms allow users to create fake profiles, enabling scammers to operate under false names.

Common Payment Platforms Used in Rental Scams

1. Cash Transfer Apps (e.g., Venmo, Cash App, Zelle)

- How Scammers Use Them: Scammers often push for payments through apps like Venmo, Cash App, and Zelle because transactions are fast, irreversible, and don’t require much information from the receiver.

- Red Flag: If a “landlord” or “agent” insists on using one of these apps, especially if they emphasize the speed or convenience, it could be a scam.

- How to Stay Safe: Only use cash transfer apps for people you trust. For rentals, stick to payment methods that offer protection, like credit cards or checks.

2. Wire Transfers (e.g., Western Union, MoneyGram)

- How Scammers Use Them: Wire transfers are one of the oldest scam tools because they’re nearly impossible to trace or reverse. Scammers may claim that wire transfers show “good faith” or “commitment.”

- Red Flag: Any landlord or agent who asks for a wire transfer, especially to a foreign bank or another state, is likely a scammer.

- How to Stay Safe: Legitimate landlords typically do not require wire transfers. If asked, suggest a safer method and assess their reaction.

3. Cryptocurrency (e.g., Bitcoin, Ethereum)

- How Scammers Use Them: Cryptocurrency is appealing to scammers because it’s difficult to trace and doesn’t allow chargebacks. Some scammers pretend to offer discounted rent or incentives for using crypto.

- Red Flag: Any request for rent payments in cryptocurrency should raise immediate suspicion.

- How to Stay Safe: Avoid paying rent in cryptocurrency, especially for initial deposits or fees. Cryptocurrency’s value can fluctuate, and there’s no recourse if the transaction is fraudulent.

4. Gift Cards (e.g., Amazon, iTunes)

- How Scammers Use Them: Though uncommon, some scammers ask for rent payments via gift cards. This is an outright red flag, as no legitimate landlord would require gift card payments for rent.

- Red Flag: Any request to pay rent with gift cards is a major red flag.

- How to Stay Safe: Decline immediately. Gift cards are commonly used in scams due to the difficulty of tracing funds once redeemed.

Common Scenarios Where Payment Platforms Play a Role

| “Holding” the Apartment with a Deposit | How It Works: Scammers ask for a deposit to “hold” the apartment for you, using platforms like Zelle, Venmo, or Cash App. Warning Sign: Real landlords usually don’t need “holding” deposits and will show you the property before any financial commitment. What to Do: Ask to see the property first. If they refuse or push for immediate payment, walk away. |

| Fake “Application Fees” or “Screening Fees” | How It Works: Scammers request application or screening fees up front via cash transfer apps or wire transfers, then disappear after payment. Warning Sign: High application fees (anything over $50) are unusual, and legitimate landlords typically use secure payment methods. What to Do: Verify fees by contacting the property management company or researching similar rentals in the area. Avoid high upfront fees. |

| “Last Minute” Payment Method Changes | How It Works: You may initially agree on a secure payment method, but just before payment, the scammer asks to switch to an untraceable platform. Warning Sign: A sudden request to use a cash transfer app, wire transfer, or cryptocurrency. What to Do: Stick to the agreed method. A last-minute switch is often a sign that something’s wrong. |

| “Landlord” Claims They’re Out of the Country | How It Works: Scammers often claim to be overseas, requesting that rent or deposit payments be sent via wire transfer or cryptocurrency. Warning Sign: Requests to send money without an in-person meeting or property tour. What to Do: Insist on meeting a representative in person or arrange a video call for a virtual tour. Decline requests to send money overseas. |

Red Flags to Watch For When Using Payment Platforms

1. Requests for Instant Payments

- Scammers often ask for instant transfers to lock in the deal quickly and prevent you from reconsidering. Platforms like Zelle and Venmo are especially risky in these cases.

2. Lack of a Paper Trail

- Many payment apps don’t provide detailed receipts, which scammers exploit. They may ask for payments in multiple small amounts to avoid triggering fraud alerts.

3. Pressure Tactics to Use a Specific Platform

- Scammers prefer platforms where money is hard to recover. If they push a specific platform over your choice, question their motives.

4. Requests for Sensitive Information

- If a “landlord” asks for sensitive data along with payment, like your banking information, it’s likely an attempt to commit identity theft alongside the rental scam.

What to Do If You Suspect a Scam

1. Report the Scammer

- Report rental scams to the Federal Trade Commission (FTC) and the Better Business Bureau (BBB). If the payment was through a cash transfer app, report the account to the platform to flag it as fraudulent.

2. Contact Your Payment Platform

- Some platforms, like PayPal, offer limited protection against scams. Contact customer support immediately if you realize you’ve been scammed, as they may be able to freeze the transaction.

3. Alert Local Law Enforcement

- File a police report, especially if the scammer used your personal information. This helps document the fraud and may aid future investigations.

4. Warn Others

- Post warnings on platforms like Section 8 Shield’s scam alert page. Your report not only adds to our database but also helps us notify renters of potential scams in real-time. This information can protect future renters, making our community safer and more informed.

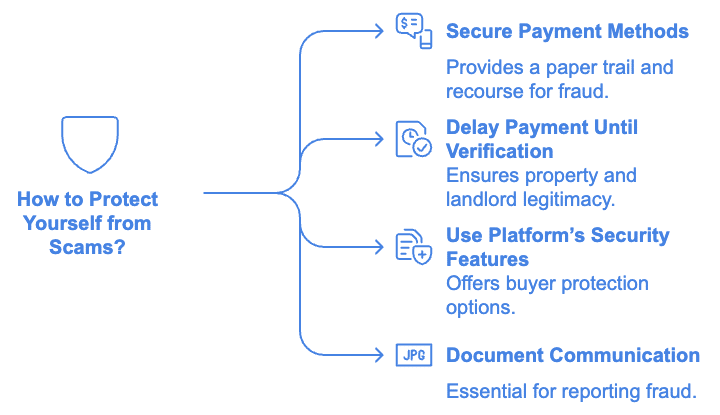

Final Thoughts: Safe Payment Practices

When it comes to renting, safe payment methods are key to protecting yourself from scams. Scammers rely on the anonymity and speed that certain payment platforms provide, so sticking to secure methods and taking the time to verify details can make all the difference. Section 8 Shield is here to guide you through these risks, offering resources and tools to keep you informed and safe in your rental journey. Stay cautious, trust your instincts, and don’t let pressure or convenience compromise your security.