Think You Qualify for Affordable Housing? Here’s the Truth About Eligibility!

July 13, 2022

How to Spot Fake Rental Listings Online

November 11, 2022Searching for affordable housing is hard enough without worrying about scams. Unfortunately, scammers often target people looking for rental properties or Section 8 housing, and one of their common tricks is fake housing applications. If you’re not careful, you could lose money or have your personal information stolen.

In this article, we’ll cover the warning signs of a housing application scam, how these scams work, and what you can do to protect yourself. Plus, we’ll explain how Section 8 Shield can help you avoid housing scams.

Common Housing Application Scams

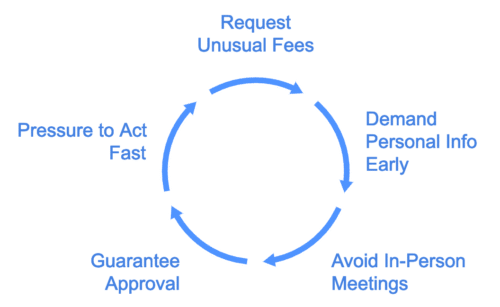

- Fake Application Fees

Many legitimate housing applications require a small fee to process your background check or credit report. Scammers take advantage of this by demanding larger fees upfront. In some cases, they’ll charge multiple fees—like separate payments for a credit check, a “holding deposit,” or a background check—none of which are real. - Requests for Personal Information Too Soon

A common tactic is to ask for sensitive personal information (like your Social Security number or bank account details) early in the process. Scammers often use this information to steal your identity or commit fraud. Legitimate landlords will typically ask for this information only after meeting you in person or after you’ve seen the property. - No In-Person Interaction

Many scammers operate online, claiming to be landlords or property managers but refusing to meet you in person. They might say they’re out of town, live in another country, or can’t meet for some other reason. These scammers will still ask for an application and fees, but they avoid personal contact to make it harder for you to verify their identity. - The “Guaranteed Approval” Trick

Legitimate landlords or property management companies usually check your background, employment history, and credit score before approving you for a rental. When someone claims that you’re “guaranteed” to get the apartment, regardless of your credit or income, it’s likely a scam. Scammers use this trick to lure in tenants who feel desperate for housing. - High Pressure to Act Fast

Scammers will push you to submit an application and payment quickly, saying things like, “There are lots of people interested, so if you want the place, you need to apply right now.” They create a false sense of urgency to prevent you from doing proper research or thinking carefully before sending money.

How to Spot a Housing Application Scam

While housing scams can be convincing, there are certain red flags that should make you stop and think before handing over your money or personal information. Here’s what to look out for:

- Unusually Low Rent

If a rental property is being offered at a price much lower than other similar properties in the area, be cautious. Scammers often use unrealistically low rents to get your attention and tempt you into sending an application fee without thinking it through. - Requests for Payment via Wire Transfer or Gift Cards

Scammers love wire transfers and gift cards because these payment methods are hard to trace and impossible to reverse. If someone asks you to pay an application fee this way, it’s almost certainly a scam. - Incomplete or Vague Property Details

If the listing or application doesn’t include important details—like the exact address, rent terms, or clear photos—be suspicious. Scammers often use fake or generic information to trick people into applying without doing proper research. - No Lease Agreement Before Payment

A legitimate landlord or property management company will usually have you sign a lease agreement before you pay any deposit or fees. When you’re asked to pay money before seeing or signing a lease, walk away. - The Landlord or Property Manager is Unavailable

If the person in charge of renting the property is constantly unavailable or gives you excuses for not meeting in person or showing you the property, be very cautious. Scammers often avoid face-to-face interaction to keep you from verifying their identity.

How Housing Application Scams Work

Most housing application scams start with a fake listing. Scammers copy real listings from websites like Craigslist, Zillow, or Facebook Marketplace, then repost them with their own contact information. When you express interest in the property, they’ll ask you to fill out an application, submit personal information, and pay a fee.

Here’s the catch: they don’t own or manage the property. After you pay, the scammer disappears, leaving you out of pocket and potentially with your personal information stolen.

Other scams involve completely fake properties—places that don’t exist or are unavailable for rent. Scammers invent listings and applications to fool you into sending money for fees or deposits that you’ll never get back.

How to Protect Yourself from Housing Application Scams

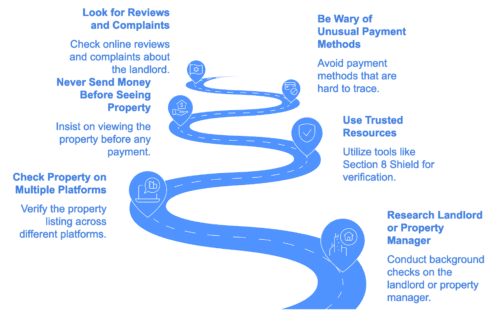

| Research the Landlord or Property Manager | Before submitting an application or sending any money, do some background research on the person or company claiming to rent the property. Search their name online, check for reviews, and see if they’ve been involved in scams before. A quick internet search can often reveal a lot about whether a landlord is legitimate or not. |

| Check the Property on Multiple Platforms | If you find a listing on Craigslist or Facebook Marketplace, cross-check it on other platforms like Zillow, Apartments.com, or Rent.com. If the listing doesn’t appear on trusted sites, or if you find the same photos and description with different contact details, you might be dealing with a scammer. |

| Use Trusted Resources Like Section 8 Shield | Section 8 Shield offers tools and information to help you verify whether a housing listing is legitimate. Our website can help you avoid scams by checking reviews, fraud reports, and warnings from other renters. We provide reliable information that can help you make an informed decision. |

| Never Send Money Before Seeing the Property | Always insist on seeing the property in person before paying any application fees, deposits, or rent. Scammers often invent reasons why they can’t show the property (like being out of town), but no legitimate landlord should expect payment before you’ve verified that the property is real. |

| Be Wary of Unusual Payment Methods | If the landlord or property manager insists on being paid by wire transfer, gift cards, or payment apps like Venmo or Zelle, it’s a major red flag. These payment methods are commonly used by scammers because they can’t be traced or recovered easily. |

| Look for Reviews and Complaints | Before submitting any application, check for online reviews of the landlord or property manager. Websites like Section 8 Shield can help you find feedback from other renters, including warnings about potential scams. Be sure to also check for complaints with the Better Business Bureau (BBB) or your state’s consumer protection agency. |

| Ask for References | If you’re still unsure, ask the landlord for references from past tenants. A legitimate landlord should have no problem providing this information. If the person refuses to give references or acts offended by your request, take it as a sign that something isn’t right. |

| Know Your Rights | Each state has its own laws regarding tenant rights and rental agreements. Understanding these laws can help you avoid falling for scams. For example, in many states, landlords are required to provide a lease agreement before asking for any payment. Be familiar with what’s legal in your state to avoid getting scammed. |

What to Do if You’ve Been Scammed

If you think you’ve been scammed, take action right away. Here’s what you can do:

- Report the Scam

Contact the website where the listing was posted (Craigslist, Facebook Marketplace, etc.) and report the scam. They might remove the listing to prevent others from falling for it. You should also file a report with the Federal Trade Commission (FTC) at consumer.ftc.gov and consider reporting the scam to your local police. - Contact Your Bank or Payment Service

If you paid any fees, contact your bank or payment service to report the scam. While recovery isn’t guaranteed, some payment services offer fraud protection and may be able to help you get your money back. - Monitor Your Personal Information

If you provide personal information (like your Social Security number), monitor your credit and bank accounts closely for any signs of identity theft. You may also want to place a fraud alert or credit freeze with the major credit bureaus. - Use Section 8 Shield’s Scam Reporting Tool

If you’ve been the victim of a housing application scam, report it through Section 8 Shield. Your report could help others avoid falling victim to the same scam, and we keep an updated database of known housing scams.

Conclusion

Housing application scams are a real threat, but by staying informed and cautious, you can avoid falling victim. Look out for the warning signs, do your research, and never rush into a decision—especially when money and personal information are involved.

Always use trusted resources like Section 8 Shield to verify the legitimacy of housing listings and landlords. Remember, if something feels off, it probably is. Protect yourself, stay vigilant, and don’t let scammers take advantage of your search for a safe and affordable home.