Why You Should Never Pay a Security Deposit Before Visiting the Property

November 12, 2022

How Scammers Use Fake Real Estate Agents

January 8, 2023When applying for housing, you may be asked to share sensitive personal information, including your Social Security Number (SSN). While this is often a legitimate part of the process, it’s also a prime opportunity for identity thieves and scammers. At Section 8 Shield, we’re here to help renters like you protect your SSN and avoid falling victim to fraud.

Why Do Landlords or Agencies Ask for Your Social Security Number?

Your SSN is often requested during the rental application process for legitimate purposes, such as:

- Running a credit check to assess your financial reliability.

- Conducting background checks to ensure you meet tenant requirements.

- Verifying your identity to comply with legal or regulatory obligations.

While these are valid reasons, sharing your SSN comes with risks. Scammers and even some unethical landlords can misuse your information, leading to identity theft or fraud.

Amanda G.

Renter in Illinois.The Risks of Sharing Your SSN

Your SSN is a gateway to your identity. If it falls into the wrong hands, it can be used to:

- Open fraudulent credit accounts in your name.

- File fake tax returns to claim refunds.

- Access your bank accounts or other financial records.

- Commit other types of identity theft that can damage your credit and reputation.

When Is It Safe to Share Your SSN?

There are situations where providing your SSN is necessary, but you should only do so with trusted entities. Here’s how to determine if it’s safe:

- Verify the Requestor

Only share your SSN with legitimate landlords or agencies. Research the landlord or rental agency to ensure they have a good reputation. For tips, read our article How to Check If a Landlord or Rental Agency Is Legitimate. - Understand the Purpose

Ask why your SSN is required and how it will be used. A reputable landlord or agency should provide clear answers. - Look for Secure Systems

Ensure the application process is secure. If submitting information online, verify that the website uses encryption (check for “https” in the URL). - Check for Alternatives

Some landlords or agencies may accept alternatives to your SSN, such as an Individual Taxpayer Identification Number (ITIN).

How to Protect Your SSN During Applications

Even when it’s necessary to share your SSN, there are steps you can take to reduce your risk:

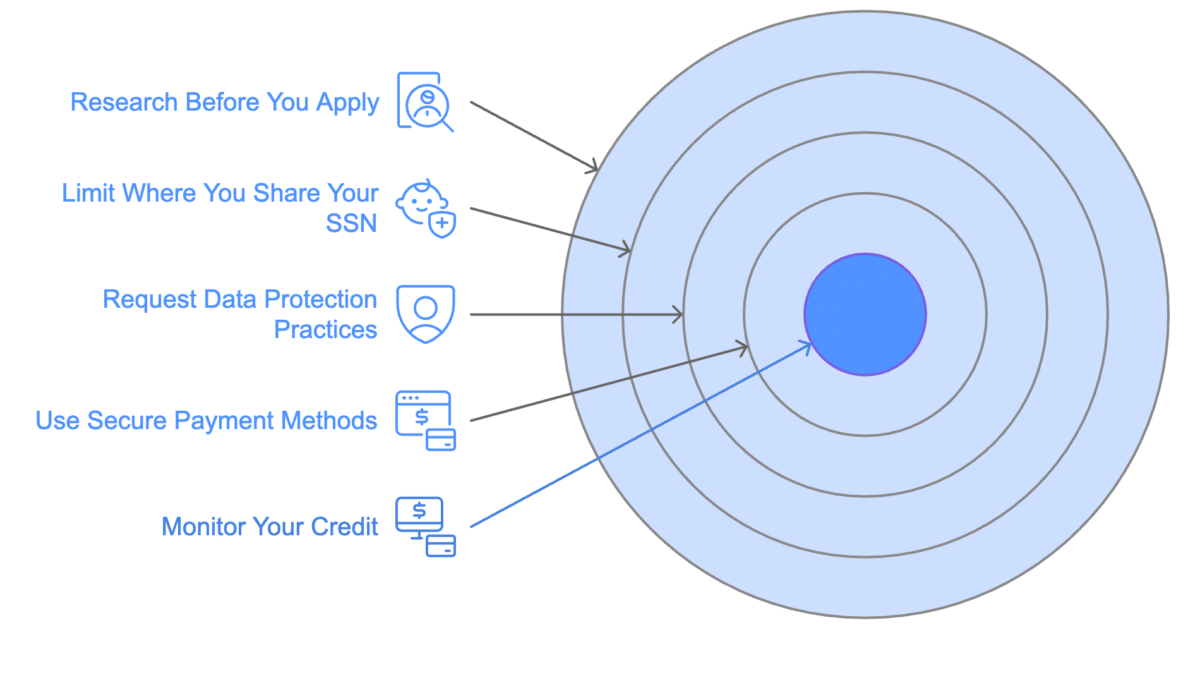

1. Research Before You Apply

Before submitting an application, investigate the landlord or rental agency:

- Check online reviews on platforms like Better Business Bureau or Trustpilot.

- Look up the landlord’s name in public property records to confirm ownership.

- Search for complaints or scams associated with their name or company.

2. Limit Where You Share Your SSN

Only provide your SSN to trusted entities. Avoid:

- Informal or verbal exchanges where there’s no documentation.

- Sharing your SSN via email or text, which are not secure.

3. Request Data Protection Practices

Ask how your information will be stored and who will have access to it. A reputable landlord or agency should have policies in place to protect your data.

4. Use Secure Payment Methods

Scammers often ask for personal information as part of fake payment requests. Only make payments through secure, traceable methods and avoid unregulated platforms like gift cards or wire transfers.

5. Monitor Your Credit

Sign up for a credit monitoring service that alerts you to suspicious activity. Many services offer free tools to monitor your credit and notify you of changes.

Red Flags to Watch For

If a landlord or agency asks for your SSN, stay alert for these warning signs:

| Refusal to Provide Information | If they won’t explain why they need your SSN or how it will be used, that’s a red flag. |

| Unprofessional Communication | Be cautious of landlords who use free email services or who don’t have a business address. |

| Requests for Payment with SSN | Scammers may try to collect both a deposit and your SSN in one transaction. |

For more examples of suspicious behavior, read our article How to Spot Fake Rental Listings Online.

What to Do If Your SSN Is Stolen

If you suspect your SSN has been compromised, act quickly to minimize the damage:

1. Report the Theft

- File a report with the Federal Trade Commission (FTC).

- Contact your local police department if the theft occurred during a rental transaction.

2. Freeze Your Credit

Place a freeze on your credit with major credit bureaus like Experian, Equifax, and TransUnion. This prevents scammers from opening new accounts in your name.

3. Monitor Your Accounts

Keep an eye on your bank statements and credit reports for unauthorized activity.

4. Inform Relevant Agencies

Notify the Social Security Administration (SSA) if your SSN has been misused. You can reach them at SSA.gov.

Real-Life Tips for Protecting Your SSN

Here are practical tips to help you safeguard your information during rental applications:

- Use Alternatives: If possible, provide an ITIN instead of your SSN.

- Limit Sharing: Only share your SSN after confirming the landlord or agency is legitimate.

- Double-Check Forms: Ensure all forms requesting your SSN are official and match the agency or landlord’s identity.

- Ask for In-Person Meetings: Whenever possible, meet with landlords face-to-face before submitting sensitive information.

Protecting Yourself Online

While sharing your SSN is sometimes unavoidable, you don’t have to feel powerless. By staying informed and taking precautions, you can reduce your risk of falling victim to identity theft.

Rachel T.

Renter in New York.At Section 8 Shield, we’re here to support renters like you. Check out our article How to Avoid Rental Scams When Relocating for more advice on staying safe during your housing search. Let’s work together to protect your personal information and secure your future.