Is My Landlord Scamming Me? What I Learned the Hard Way

April 15, 2022

Think You Qualify for Affordable Housing? Here’s the Truth About Eligibility!

July 13, 2022Relocating to a new city or state is exciting but can be stressful, especially when it comes to finding a place to live. Unfortunately, rental scams often target people moving long distances, knowing they’re less familiar with the local market and may be willing to secure housing without an in-person visit. At Section 8 Shield, we’re here to guide you through practical steps and precautions to help you avoid rental scams when relocating.

Why Renters Relocating Are Targeted

Scammers focus on renters relocating because they know the challenges of moving often lead people to make quicker, less-informed decisions. Relocating renters may:

- Have limited time to secure housing before a move.

- Be less familiar with average rental prices or neighborhoods.

- Feel pressured to settle for an online-only rental arrangement due to distance.

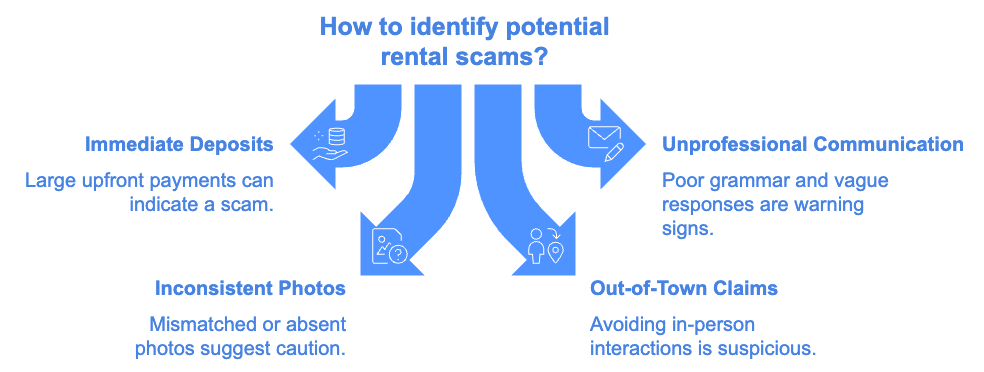

Scammers exploit these factors by creating fake listings, rushing the rental process, or demanding quick payments to “secure” a property. Here’s how you can protect yourself from these scams.

Common Rental Scams Targeting Relocating Renters

| Phantom Rentals | How It Works: Scammers create fake listings for attractive, well-priced rentals that don’t exist. They’ll often provide enticing photos or even conduct virtual tours. After collecting deposits or fees, they disappear. Warning Signs: The property is unavailable for an in-person tour, the deal seems too good to be true, or the “landlord” is unresponsive after payment. How to Avoid It: Insist on an in-person or virtual tour with a live camera walkthrough. Research the property address online to see if it’s legitimately available for rent or if it has a history of rental scams. |

| Fake Property Management Companies | How It Works: Scammers pose as a property management company, often creating websites that appear professional. They’ll list multiple properties and offer competitive prices, requesting application fees and deposits up front. Warning Signs: Limited contact options, push for upfront payments, and inability to verify company credentials or office location. How to Avoid It: Verify the company’s legitimacy by checking online reviews, business registries, and local housing authorities. Be cautious if you can’t find consistent, positive information about the company. |

| High-Pressure Payment Demands | How It Works: Scammers push renters to pay deposits or first month’s rent immediately, claiming high demand or multiple applicants. They want you to feel pressured into paying without verifying the property or reading the lease. Warning Signs: Urgent payment demands, pushy behavior, or refusal to provide a standard lease agreement. How to Avoid It: Don’t rush. Legitimate landlords will provide you with enough time to review agreements and won’t pressure you for immediate payment. |

| False Listings on Social Media | How It Works: Scammers post rental listings on social media or marketplace platforms like Facebook Marketplace. They often copy information from real listings or create their own and disappear after collecting fees. Warning Signs: Lack of detailed property information, reluctance to communicate through official channels, and push for quick payments. How to Avoid It: Stick to trusted rental websites, and verify any social media listings by cross-checking them on reliable platforms. Avoid social media listings that ask for untraceable payments. |

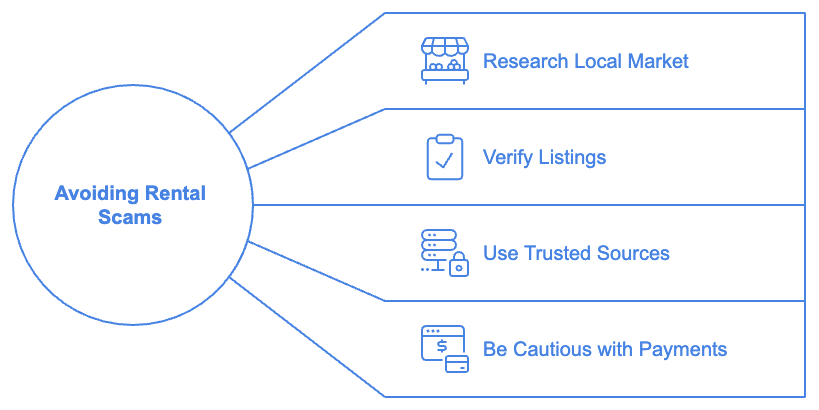

Key Steps to Avoid Rental Scams When Relocating

1. Research the Neighborhood and Average Rent Prices

- What to Do: Use local real estate websites, online forums, or neighborhood guides to understand what’s typical for rent prices in your target area.

- Why It’s Important: Scammers often price fake listings well below the market rate to attract interest. Knowing the average price range helps you spot suspiciously cheap rentals.

- Resources to Use: Websites like Zillow, Apartments.com, and city-based rental guides can give you a good idea of typical rental costs.

2. Verify Property Ownership

- What to Do: Contact the local property records office or use online property databases to verify the owner’s name and property details.

- Why It’s Important: Verifying property ownership can help you ensure you’re dealing with the legitimate owner or an authorized agent. Scammers often don’t have this documentation and rely on renters not checking.

- How to Do It: Many counties provide online access to property records. You can also ask the “landlord” or agent for proof of ownership or authorization.

3. Use Virtual Tours Carefully

- What to Do: If you can’t visit in person, request a live virtual tour where the person showing the property can answer questions and demonstrate specific details, like opening cabinets or turning on appliances.

- Why It’s Important: Scammers often use pre-recorded videos or staged photos, but a live virtual tour is harder for them to fake.

- Questions to Ask: Ask the person to show specific areas, like inside closets or under sinks, to ensure they’re actually in the property and familiar with its details.

4. Ask for a Standard Lease Agreement

- What to Do: Request a copy of the lease agreement to review before making any payments. Look for standard terms and clauses and be wary of any vague language or missing details.

- Why It’s Important: Fake lease agreements often lack standard terms or include unusual requirements. Reviewing the lease can reveal red flags, such as extreme penalties for minor issues.

- Key Clauses to Review: Look for clauses about rent payment, maintenance responsibilities, security deposit terms, and tenant rights. Compare with standard leases to spot discrepancies.

5. Be Wary of Unusual Payment Methods

- What to Do: Avoid payment methods like wire transfers, gift cards, or cash transfer apps (e.g., Cash App, Venmo), which make it hard to recover funds if something goes wrong.

- Why It’s Important: Scammers prefer these payment methods because they’re difficult to trace. Instead, use secure methods like checks or credit cards.

- Safe Payment Options: Stick to payments with a paper trail, like checks or credit cards, which provide more protection against fraud.

6. Get Contact Information and Check Reviews

- What to Do: Ask for multiple contact options, including a phone number, email, and office address. Verify the information by calling or searching online reviews.

- Why It’s Important: Fake agencies or landlords often rely on minimal contact methods to avoid accountability. Checking reviews and verifying contact information adds a layer of security.

- Sites for Reviews: Look for reviews on reputable sites like the Better Business Bureau (BBB), Yelp, or Google Reviews. Be cautious if there are no reviews or if feedback is overwhelmingly negative.

What to Do If You Suspect a Rental Scam

1. Report the Scam on Section 8 Shield

- Report suspicious listings or behavior to Section 8 Shield’s scam alert page. This helps alert other renters and adds to our database of known scams, protecting future renters.

2. Contact Local Housing Authorities

- Report the scam to local housing authorities in the area you’re moving to. They may have additional resources or advice and can help flag fraudulent listings.

3. Notify Your Payment Platform

- If you paid through a cash transfer app, credit card, or bank, contact your payment provider immediately. Some platforms offer limited fraud protection and may be able to freeze or reverse transactions.

4. File a Police Report

- Rental scams are illegal, and filing a police report documents the fraud. This can be useful if you pursue legal action or if law enforcement needs information for a larger investigation.

Staying Safe While Relocating

Relocating comes with enough challenges without the added stress of rental scams. By following these tips and taking time to verify listings and rental agents, you can protect yourself from fraud. Section 8 Shield is here to provide resources, tools, and