Hidden Fees in Affordable Housing: What’s Legitimate and What’s Not

November 18, 2024

Rental Scams Using Fake Property Photos: How to Spot Them

November 19, 2024Social media platforms like Facebook Marketplace, Instagram, and even TikTok have become popular places for finding rental listings. While they can be convenient, they also provide scammers with an easy way to target unsuspecting renters. At Section 8 Shield, we’ve seen an increase in reports from renters who fell victim to fake listings or fraudulent landlords through social media. This guide will show you how to identify scams, protect yourself, and safely navigate social media platforms when searching for a rental.

Why Social Media is a Target for Rental Scams

Social media platforms allow anyone to post rental listings, often with little or no oversight. Scammers take advantage of this by creating fake listings, impersonating landlords, and luring renters with appealing photos and low prices. The casual nature of social media interactions makes it easy for scammers to pressure renters into quick decisions before they realize something’s off.

Our readers have shared stories of being tricked by listings on Facebook Marketplace or Instagram, where scammers demanded deposits upfront, provided fake lease agreements, or disappeared after collecting money. As one renter told us:

Jessica

29, IllinoisThis kind of experience is, unfortunately, common. But with the right strategies, you can protect yourself and avoid falling into these traps.

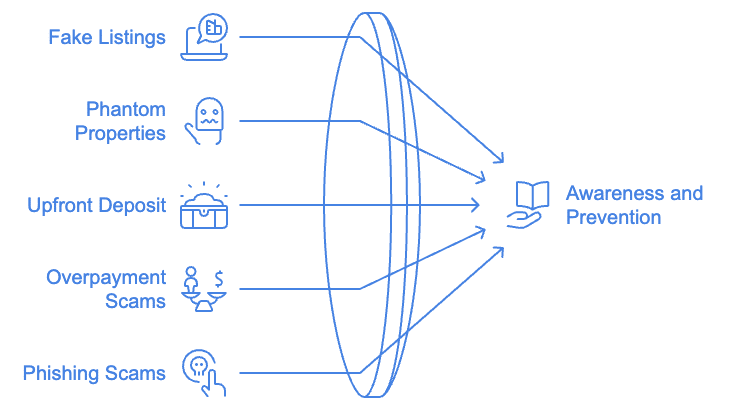

Common Social Media Rental Scams

Here are some of the most frequent scams renters encounter on social media platforms:

1. Fake Listings with Stolen Photos

- How It Works: Scammers post photos of real properties they’ve stolen from legitimate listings, often advertising them at too-good-to-be-true prices. They use these listings to lure renters into sending deposits.

- How to Spot It: Look out for listings with limited information or prices significantly lower than similar rentals in the area. Use reverse image search tools like Google Images to check if the photos have been used elsewhere.

2. Phantom Properties

- How It Works: The listing is for a property that doesn’t exist, or the scammer doesn’t have the authority to rent it. Scammers pressure renters to pay deposits before they realize the property isn’t real.

- How to Spot It: If the “landlord” refuses to show the property in person or makes excuses like being “out of town,” this is a major red flag.

3. Upfront Deposit Scams

- How It Works: The scammer demands an upfront payment (e.g., for a deposit, application fee, or first month’s rent) and disappears once the payment is made.

- How to Spot It: Legitimate landlords won’t require payment before you’ve signed a lease or seen the property.

4. Overpayment Scams

- How It Works: The scammer sends a check for more than the agreed amount and asks you to refund the difference. The check later bounces, and you’re left covering the loss.

- How to Spot It: Be cautious of any situation where you’re asked to send money back to a landlord or potential roommate.

5. Phishing Scams

- How It Works: Scammers pose as landlords or property managers and send links to fake applications or “tenant portals” designed to steal your personal information.

- How to Spot It: Avoid clicking on links in messages from unknown individuals. Verify URLs and ensure they belong to a legitimate property management website.

Actionable Tips to Avoid Social Media Rental Scams

Protecting yourself on social media requires vigilance and a few proactive steps. Here’s how to stay safe:

| Verify the Landlord or Property Manager | Research the landlord’s name, contact information, and any associated property management company. Look for online reviews or listings of other properties they manage. Check public property records to confirm the landlord owns the property. |

| Never Pay Before Seeing the Property | Insist on touring the property in person. If you’re relocating and can’t visit in person, ask for a live virtual tour. A legitimate landlord should be able to show you the property in real time. Be cautious if the landlord demands a deposit or payment upfront, especially if they refuse to meet in person. |

| Cross-Check the Listing Across Platforms | Many legitimate landlords list properties on multiple platforms. If you find the same listing with different details (e.g., different rent amounts or contact information), it could be a scam. |

| Use Secure Payment Methods | Avoid cash, wire transfers, or payment apps like Venmo or Cash App for deposits. Use a secure method, such as a check or credit card, which provides a record of the transaction. |

| Beware of High-Pressure Tactics | Scammers often try to create a sense of urgency, claiming that the property will be rented to someone else if you don’t act immediately. Take your time to verify the details before making any decisions. |

| Check the Listing for Red Flags | Look for poor grammar, vague descriptions, or prices that are much lower than comparable properties. These are often signs of a fake listing. |

| Use Trusted Platforms | Whenever possible, use rental websites or social media pages verified by trusted organizations or housing authorities. Many cities have official housing groups on Facebook where landlords are vetted. |

| Protect Your Personal Information | Be cautious about sharing sensitive information, such as your Social Security number or bank details, until you’ve confirmed the legitimacy of the landlord and the rental agreement. |

What to Do If You Suspect a Scam

If you come across a suspicious listing or believe you’ve been targeted by a scammer, here’s what you can do:

1. Report the Scam on Section 8 Shield

- Section 8 Shield’s Report a Scam page allows you to share your experience and warn others about suspicious listings. By reporting scams, you help protect the community from future fraud.

2. Alert the Social Media Platform

- Use the platform’s reporting tools to flag the listing or account. Most social media platforms take scams seriously and will investigate reported accounts.

3. Contact Local Authorities

- If you’ve lost money or provided personal information, file a report with your local police department. They may not recover your funds immediately, but having a record is essential for future investigations.

4. Notify Consumer Protection Agencies

- Report the scam to your state’s consumer protection agency or the Federal Trade Commission (FTC). They track scams and can provide resources to help you.

5. Monitor Your Finances

- If you’ve shared financial information or sent money, keep an eye on your bank account and credit report. Consider placing a fraud alert on your credit file to prevent further misuse.

Staying Safe on Social Media

Social media can be a valuable tool for finding rentals, but it’s also a space where scammers thrive. By staying vigilant and following the steps outlined in this guide, you can protect yourself from rental scams and confidently search for housing online.

At Section 8 Shield, we’re here to support renters with resources, scam alerts, and a platform to share your experiences. If you’ve encountered a suspicious listing, visit our Report a Scam page to help us protect others. Together, we can create a safer, more informed community for renters everywhere.

Remember, trust your instincts, verify every detail, and never let pressure rush you into making a decision. A little caution goes a long way in keeping your rental search safe and successful.