How to Recognize and Avoid Fake Eviction Notices

November 18, 2024

How to Avoid Rental Scams on Social Media

November 19, 2024Affordable housing is designed to provide low-cost rental options, but some renters are surprised by extra fees that pop up along the way. While some fees are legitimate and expected, others can be unnecessary or even illegal. At Section 8 Shield, we’ve researched the common fees in affordable housing to help you understand what’s normal, what’s questionable, and what might be a red flag. This guide will walk you through different types of fees, helping you know what to expect and how to avoid being overcharged.

Why Affordable Housing Has Additional Fees

Affordable housing programs like Section 8 and other low-income housing initiatives often have strict rent guidelines, but landlords or property management companies may charge additional fees for various services or amenities. While some of these fees are legal and cover essential services, others may be unnecessary or inflated. Knowing what fees are legitimate can help you budget better and avoid overpaying.

Common Legitimate Fees in Affordable Housing

Certain fees are standard in affordable housing and are generally considered legitimate. Here’s what you might expect:

1. Application Fees

- What It Covers: Application fees usually cover the cost of processing your rental application, background checks, and credit checks. These fees are often limited to ensure affordability.

- What’s Legitimate: In many states, application fees are capped, especially in affordable housing, and should be a reasonable amount (usually $30–$50).

- Red Flags: High application fees or multiple charges for “processing” or “screening” are not standard and may be excessive. Check your state’s laws to see if there’s a legal cap.

2. Security Deposit

- What It Covers: The security deposit is a standard part of most rental agreements, covering potential damages and unpaid rent. Many affordable housing programs limit the deposit amount to ensure it remains affordable.

- What’s Legitimate: A security deposit of one month’s rent is typical, though some states allow up to two months’ rent. The deposit should be refundable at the end of your lease if there are no damages or outstanding charges.

- Red Flags: Non-refundable “security deposits” or deposits higher than what’s legally allowed in your state can be a warning sign. Be sure to ask for clarification if any part of the deposit is listed as “non-refundable.”

3. Utility Fees

- What It Covers: Depending on your lease, you may be responsible for paying certain utilities, such as electricity, water, or gas. In affordable housing, some utilities may be covered, while others are the tenant’s responsibility.

- What’s Legitimate: It’s normal for tenants to pay for utilities, especially if it’s stated in the lease. Sometimes, a property management company will pass utility costs along to tenants based on actual usage.

- Red Flags: Be cautious of “flat” utility fees that seem excessive or aren’t based on actual usage. Confirm with your landlord how utility costs are calculated to avoid overpaying.

4. Late Payment Fees

- What It Covers: Late fees are a standard penalty if rent is not paid on time. However, in affordable housing, these fees are often capped to prevent excessive charges.

- What’s Legitimate: Late fees should be clearly outlined in your lease agreement and must follow local and state regulations. Many states limit late fees to a certain percentage of the monthly rent (typically 5%).

- Red Flags: Excessive late fees or unexpected “penalties” are not standard. Verify your lease terms and local laws if you’re charged more than expected.

5. Key or Entry Device Fees

- What It Covers: Fees for keys, key fobs, or access cards are standard in some apartment buildings, as they cover the cost of issuing and maintaining secure entry devices.

- What’s Legitimate: An initial fee for keys or access cards may be reasonable, especially if it’s mentioned in the lease. Some properties charge a small fee for replacements if you lose your key or entry device.

- Red Flags: High fees for entry devices or excessive replacement charges may be a warning sign. Confirm the policy on entry devices with your landlord.

Questionable Fees to Watch For

Some fees might be legal but could be considered questionable or unnecessary, especially if they seem out of line with typical rental costs.

| “Administrative” or “Processing” Fees | What It Is: These fees are sometimes charged as a general administrative cost for managing your lease or processing applications. Why It’s Questionable: In most cases, legitimate administrative costs are already covered by the application fee or rent. Additional “processing” fees are often excessive and may be avoidable. What to Do: Ask for a breakdown of what this fee covers. If it’s vague or seems redundant, consider negotiating with the landlord to remove or reduce it. |

| Move-In or Move-Out Fees | What It Is: Some landlords charge a fee to cover cleaning, maintenance, or other services related to your move-in or move-out. Why It’s Questionable: While move-in fees are becoming more common, they may not always be necessary, especially if you’re already paying a security deposit. Affordable housing programs often discourage these fees. What to Do: Ask if the security deposit already covers these costs. If a move-in or move-out fee is required, confirm that it’s a one-time charge and not recurring. |

| Pet Fees or “Pet Rent” | What It Is: Some properties charge a fee or monthly “pet rent” for having animals in the unit. This fee usually covers additional maintenance or potential damage caused by pets. Why It’s Questionable: While a one-time pet fee or small monthly pet rent may be legitimate, excessive charges can be unfair, especially in affordable housing. What to Do: If you have a service animal, these fees may not apply under the Fair Housing Act. Ask for a breakdown of pet fees and confirm if they’re refundable. |

Red Flags: Fees That May Be Illegal or Unethical

Some fees are not only questionable but may be outright illegal or unethical. Here are some red flags to watch for:

1. “Non-Refundable” Security Deposit

- Why It’s a Red Flag: Security deposits are intended to cover damages and unpaid rent, so they’re typically refundable if the unit is in good condition. A non-refundable security deposit may be illegal in some states.

- What to Do: Ask for clarification on any non-refundable fees and check your state’s regulations. Some landlords mislabel cleaning or administrative fees as “security deposits,” which can be misleading.

2. “Holding” or “Reservation” Fees That Don’t Go Toward Rent

- Why It’s a Red Flag: Some landlords ask for a holding fee to reserve a unit, but these fees should generally go toward your first month’s rent if you move in. Non-refundable holding fees may be illegal in some areas.

- What to Do: Ask if the holding fee will apply to your rent or if it’s refundable. Avoid paying non-refundable holding fees unless you’re confident you’ll move in.

3. Unexplained “Repair” Fees Charged After Move-Out

- Why It’s a Red Flag: Landlords are allowed to deduct repair costs from your security deposit, but they must provide an itemized list. Unexplained repair fees can be a way to avoid returning your deposit.

- What to Do: Request an itemized list of repairs and ask for receipts. Many states require landlords to provide this documentation if they deduct from your deposit.

4. “Eviction Prevention” Fees

- Why It’s a Red Flag: Some landlords charge “eviction prevention” fees as a way to discourage late payments, but these are often unnecessary and can exploit renters’ fear of eviction.

- What to Do: Ask for details on what this fee covers and check if it’s a standard part of the lease. If it’s not, consider negotiating to have it removed.

5. Unapproved Fees for Repairs or Maintenance Requests

- Why It’s a Red Flag: Landlords are responsible for routine maintenance and repairs under most lease agreements. Charging tenants for normal wear-and-tear repairs is usually against tenant protection laws.

- What to Do: Review your lease and local laws regarding maintenance responsibilities. If the landlord tries to charge you for standard repairs, remind them of your rights as a tenant.

How to Avoid Unnecessary Fees in Affordable Housing

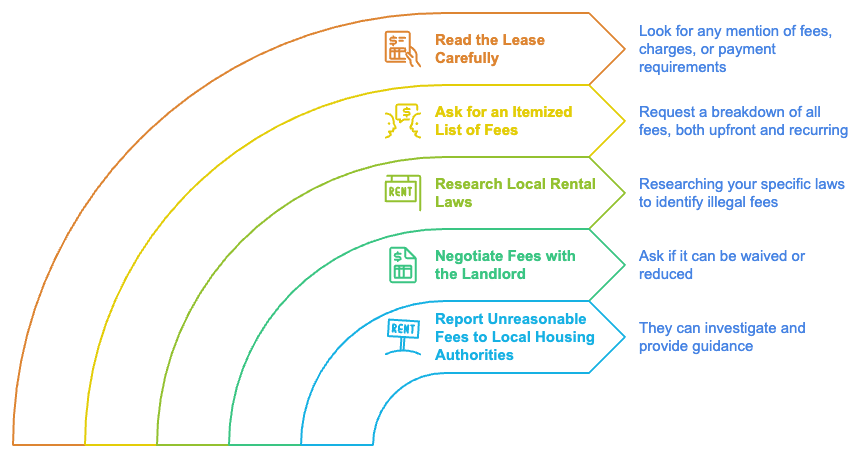

Here are some tips to help you avoid overpaying or getting stuck with hidden fees:

Protecting Yourself from Hidden Fees

Navigating fees in affordable housing can be challenging, but knowing what to expect and understanding your rights can protect you from overpaying. Section 8 Shield is here to help renters with information and support so that they can secure safe, affordable housing without unexpected costs.

By being proactive, reading your lease carefully, and questioning unusual fees, you can avoid common pitfalls and enjoy a more stable, affordable housing experience.