What to Do If You’ve Been Scammed in a Rental Agreement

February 2, 2024

The Latest Scams Targeting Section 8 Applicants: What You Need to Know

October 18, 2024When you move into a new rental, you might think about decorating, arranging furniture, or finding the closest grocery store. What you may not think about is what happens if an accident, theft, or natural disaster strikes. Rental insurance, often called renters insurance, is one of the most critical steps to protect yourself and your belongings in any rental property. Not only does it protect you financially, but having it (or not) can impact your future as a renter.

What Is Renters Insurance?

Renters insurance is a type of insurance policy designed specifically for people who rent their homes or apartments. It’s generally inexpensive and provides essential protections, including:

- Personal Property Coverage: This covers the cost to replace or repair your belongings if they’re stolen, damaged, or destroyed by events like fire, storms, or vandalism.

- Liability Coverage: If someone is injured in your home or if you accidentally damage someone else’s property, this part of the policy covers the costs. For instance, if a visitor slips and gets hurt, your policy can cover their medical expenses.

- Additional Living Expenses (ALE): If an event like a fire makes your rental uninhabitable, ALE covers temporary housing and related expenses, like food and travel costs.

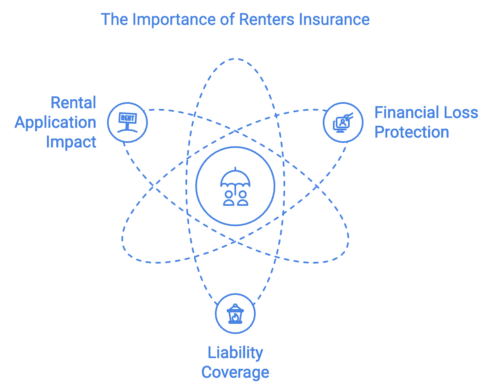

Why Renters Insurance Is Crucial

Many renters assume that the landlord’s insurance policy will cover them in the event of a disaster. This is a major misconception. Landlord insurance only protects the building, not your personal property or liability. Without renters insurance, you’re taking on significant financial risks, and even a small incident could spiral into a situation that leaves you with a debt, or worse, a damaged rental history.

Risks of Not Having Renters Insurance

- Financial Loss from Damaged or Stolen Property

- Imagine coming home to find your place burglarized. Without renters insurance, there’s no coverage for your stolen electronics, furniture, or other belongings. Replacing everything out of pocket can add up to thousands, if not more.

- Fires, floods, or storms are unpredictable, but they’re not uncommon. Renters insurance helps you replace your things after such events, sparing you a potentially huge financial loss.

- Liability for Accidents and Damages

- If you or your guests accidentally damage the property, the landlord can hold you responsible. For example, if a candle falls and causes a fire, you’d be responsible for the damage, not the landlord. Renters insurance covers the costs if an accident like this happens.

- Liability coverage also protects you from lawsuits if someone is injured on your property. Without it, you could face significant legal and medical costs if someone gets hurt and decides to sue.

- Denial of Future Rental Applications

- Many landlords now require proof of renters insurance before approving an application. If you don’t have it, landlords may view you as a risk, making it harder to find a new place to rent.

- If you leave behind unpaid repair bills or don’t cover damages, it could go on your rental history. Future landlords may see this and deny your application, viewing you as a high-risk tenant.

How Renters Insurance Protects You

Covers Personal Belongings Anywhere

Most renters insurance policies cover your belongings not only in your home but also while traveling. If your laptop is stolen from your car, renters insurance can cover it. This broad protection ensures that you have coverage for personal items wherever you are, adding an extra layer of security.

Offers Liability Coverage for More Than Accidents at Home

Liability coverage from renters insurance often extends beyond your rental. If you accidentally cause damage or injury outside your home, your policy may still cover you. This can include things like accidentally breaking someone’s property while on vacation or at a friend’s house.

Provides Peace of Mind and Quick Recovery

When disaster strikes, renters insurance provides financial relief that allows you to recover faster without depleting your savings or going into debt. Knowing that you’re covered helps relieve the stress and burden of the unexpected, especially when you’re juggling other costs like rent and utilities.

What’s Typically Covered and Not Covered by Renters Insurance?

Knowing what renters insurance covers and doesn’t cover is essential to understand its value. Here’s a general breakdown:

- Covered by Renters Insurance:

- Theft, fire, smoke damage, and some types of water damage (usually not flooding, though).

- Liability for injuries to others or damage to their property.

- Additional living expenses if your home becomes uninhabitable.

- Not Covered by Renters Insurance:

- Flooding: This requires a separate flood policy.

- Earthquakes: Usually not covered unless you purchase an add-on policy.

- High-value items: Some policies have limits on items like jewelry or collectibles. You may need extra coverage for these.

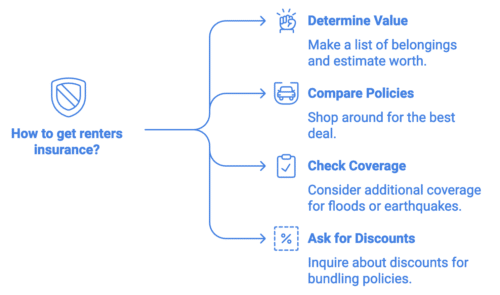

Steps to Get Renters Insurance

- Determine the Value of Your Belongings: Make a list of everything you own and estimate its worth. This helps you decide how much coverage you need.

- Compare Policies: Different insurance providers offer various options, so shop around for the best deal.

- Check for Additional Coverage Needs: If you live in an area prone to flooding or earthquakes, consider additional coverage.

- Ask About Discounts: Some providers offer discounts if you bundle renters insurance with other policies, like auto insurance.

How Much Does Renters Insurance Cost?

Renters insurance is typically very affordable, often ranging from $10 to $20 per month depending on the coverage amount and location. This small investment can save you thousands in the long run. The cost of renters insurance varies based on factors like your location, the value of your belongings, and any extra coverage options you choose.

What to Do if a Landlord Requires Renters Insurance

It’s increasingly common for landlords to require tenants to carry renters insurance. Here’s what you should know:

- Why Landlords Require It: Renters insurance reduces the risk for landlords. If an incident occurs, they’re less likely to be dragged into disputes over damages or liability. Additionally, it shows the tenant is responsible.

- How to Show Proof: Most insurers provide a certificate of insurance that you can submit to your landlord. Keep this document handy and make sure it’s up to date.

Common Myths About Renters Insurance

- “I Don’t Own Anything Valuable”

- Think again! Furniture, electronics, kitchenware, and clothing add up quickly. If you had to replace all of these items at once, you’d be facing a significant expense.

- “It Won’t Happen to Me”

- The reality is that accidents, thefts, and natural disasters happen all the time. Renters insurance prepares you for the unexpected.

- “It’s Too Expensive”

- As mentioned, renters insurance is generally very affordable. The cost of going without it can be far greater if something goes wrong.

Tips to Make the Most of Your Renters Insurance

| Take an Inventory | Keep a detailed list of your belongings, ideally with photos and receipts. This makes filing a claim much easier and faster. |

| Update Your Policy Regularly | If you buy new furniture or electronics, update your policy to cover these additions. |

| Know Your Deductible | The deductible is the amount you pay before insurance kicks in. Choose a deductible that you can afford in case you need to make a claim. |

Conclusion: Don’t Skip Renters Insurance

Skipping renters insurance is a risk that can have long-lasting consequences. Without it, you risk financial losses, potential lawsuits, and even a bad rental history if you can’t cover costs in an emergency. Think of renters insurance as a low-cost way to protect yourself from the unexpected.

If you’re renting, prioritize renters insurance as part of your monthly expenses. It’s a small price for a big safety net, ensuring that you, your belongings, and your rental record are protected.