Section 8 Application Denied? Understand How to Fight Back

January 4, 2024

Rental Insurance: Why It’s Essential for Every Tenant

September 3, 2024Realizing you’ve been scammed in a rental agreement can be overwhelming and stressful. Whether you’ve lost money to a fake landlord, discovered a fraudulent listing, or faced identity theft after sharing personal information, there are steps you can take to address the situation. At Section 8 Shield, we’ve compiled this guide to help you navigate what to do if you’ve been scammed in a rental agreement, so you can minimize the impact, protect your identity, and potentially recover lost funds.

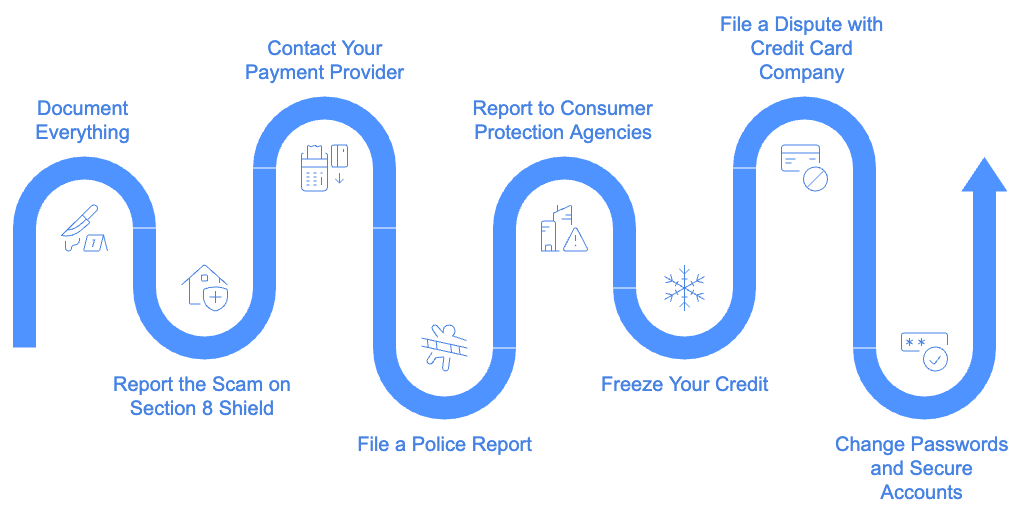

1. Document Everything

- Why It’s Important: Having a record of all interactions and transactions related to the scam is crucial if you decide to file a police report, dispute charges, or pursue legal action.

- What to Include: Save emails, texts, screenshots, receipts, and any agreements or documents you signed. If you paid by check or bank transfer, keep those transaction records as well.

- How It Helps: Detailed documentation helps law enforcement, consumer protection agencies, and financial institutions investigate your case and may improve your chances of recovering your funds.

2. Report the Scam on Section 8 Shield

- Why It’s Important: Reporting the scam can alert other renters to the fraudulent landlord or agency and help prevent similar scams in the future.

- How to Report: Visit Section 8 Shield’s scam alert page and provide details about your experience, including the scammer’s name, contact information, and any suspicious behavior.

- How It Helps: Your report adds to a public database of rental scams, which strengthens the community’s defenses against fraud.

3. Contact Your Payment Provider

- Why It’s Important: If you paid any fees or deposits, you may be able to stop, reverse, or dispute the transaction depending on the payment method.

- What to Do: Reach out to your bank, credit card company, or payment app (e.g., PayPal, Venmo, Zelle) and report the transaction as fraudulent. Explain the situation in detail and provide any documentation of the scam.

- How It Helps: Some financial institutions offer fraud protection, especially for credit card payments. If the transaction can’t be reversed, they may still flag the scammer’s account, making it harder for them to continue scamming others.

4. File a Police Report

- Why It’s Important: Filing a police report creates a formal record of the scam, which can support any financial disputes, assist with identity theft protection, and aid in future legal claims.

- What to Include: Provide all evidence of the scam, including communication with the landlord or agency, payment records, and any documents you signed.

- How It Helps: A police report may not immediately recover your money, but it strengthens your case when dealing with other institutions and may help local authorities track rental scams in your area.

5. Report the Scam to Federal and State Consumer Protection Agencies

- Why It’s Important: Consumer protection agencies can investigate rental scams, and many maintain databases of known scammers to alert the public.

- Where to Report:

- Federal Trade Commission (FTC): Visit FTC’s fraud reporting page to file a complaint.

- Better Business Bureau (BBB): Report the scammer or agency on the BBB website, which helps warn other renters in your area.

- State Attorney General: Many states have online portals for reporting rental fraud, so check your state’s attorney general website.

- How It Helps: These agencies use reports to track patterns in rental fraud and may be able to assist in your case. Filing a report also helps protect future renters by adding to scam alerts and warnings.

6. Freeze Your Credit if Sensitive Information Was Shared

- Why It’s Important: If you provided personal information, such as your Social Security number or bank account details, scammers may try to open new accounts or commit identity theft.

- How to Freeze Your Credit:

- Contact each of the major credit bureaus (Experian, Equifax, and TransUnion) to freeze your credit. This prevents new accounts from being opened in your name.

- Consider signing up for a credit monitoring service, which will alert you to any suspicious activity.

- How It Helps: Freezing your credit helps prevent identity theft and protects your credit score from unauthorized inquiries or new accounts.

7. File a Dispute with Your Credit Card Company if Applicable

- Why It’s Important: If you paid any rental fees or deposits with a credit card, many issuers offer fraud protection that can help you recover the funds.

- How to File a Dispute: Contact your credit card company and explain that you were scammed. Provide details about the transaction, the scam, and any evidence you’ve gathered.

- How It Helps: Credit card companies often have built-in fraud protections that allow you to dispute charges. Successful disputes may result in a refund or chargeback on the transaction.

8. Change Passwords and Secure Your Online Accounts

- Why It’s Important: Scammers may have obtained your personal information or access to your financial accounts, which puts you at risk for further scams or fraud.

- What to Do:

- Change your passwords for email, bank accounts, and any payment apps you used during the rental process.

- Enable two-factor authentication on all sensitive accounts to add an extra layer of security.

- How It Helps: By securing your online accounts, you reduce the risk of further exploitation by scammers and make it harder for them to access your information.

9. Alert Local Housing Authorities

- Why It’s Important: Many cities have housing departments or authorities that track and manage rental fraud cases. Reporting your experience helps them identify local scam trends and may provide additional resources.

- How to Report: Contact your city’s housing authority or tenant protection office. Explain the scam in detail and provide any documentation you have.

- How It Helps: Local authorities may offer resources for victims of rental scams or provide legal advice. Your report also contributes to efforts to reduce rental fraud in your area.

10. Consider Small Claims Court if the Loss Was Significant

- Why It’s Important: If you lost a large sum of money, you may be able to sue the scammer in small claims court, particularly if you have their name and contact information.

- How to File: Research the process for small claims court in your state. Prepare all evidence, including documentation of the scam, police reports, and financial records. Small claims court does not require a lawyer, and you can typically represent yourself.

- How It Helps: While there’s no guarantee of recovering your money, a small claims court judgment can hold the scammer accountable and may lead to a court order for repayment.

Additional Tips to Protect Yourself After a Rental Scam

1. Keep Monitoring Your Credit and Bank Statements

- Continue checking your credit report and bank statements for any suspicious activity. Regular monitoring helps catch identity theft early and ensures you can respond promptly to unauthorized transactions.

2. Stay Vigilant for Future Scams

- After experiencing a scam, be extra cautious with future rental agreements. Verify landlords and rental agencies, and don’t share sensitive information until you’ve confirmed legitimacy.

3. Spread the Word to Help Others

- Share your experience with friends, family, and online rental communities. Informing others about common scams and warning signs can help prevent more people from becoming victims.

Recovering After a Rental Scam

Falling victim to a rental scam can be a difficult experience, but taking these steps can help you regain control, protect your identity, and potentially recover your money. Section 8 Shield is here to support renters by providing resources, tools, and a platform for reporting scams to keep the rental market safer for everyone.

Remember, your safety and peace of mind are top priorities. Protect your information, report the scam, and seek assistance from consumer protection agencies to minimize the impact of rental fraud.