How to Protect Your Personal Information During Rental Applications

March 23, 2023

How to Check If a Housing Website is Legit: A Step-by-Step Guide

May 10, 2023The rental application process often requires sharing sensitive information, which unfortunately makes it a prime opportunity for identity theft. At Section 8 Shield, we’ve seen how scammers exploit renters through fake listings, bogus applications, and requests for excessive personal information. This guide will walk you through common identity theft risks in the rental process and the steps you can take to protect yourself.

Why Renters Are Vulnerable to Identity Theft

Renters are particularly vulnerable to identity theft because they’re typically required to provide sensitive information, like Social Security numbers, bank details, and employment information. Scammers know this and target renters through fake listings, posing as landlords or property management companies to trick people into giving up personal information.

Our readers have shared stories about being asked for unusual information or payment methods, and in some cases, they only discovered the scam after their personal information was misused. Identity theft can result in long-term consequences, including damage to your credit score, unauthorized financial transactions, and even legal issues.

Common Identity Theft Tactics in the Rental Process

Here are some of the most common ways scammers attempt to steal your identity during the rental process.

| Fake Rental Applications | How It Works: Scammers create fake listings and collect “applications” from multiple renters, requesting personal information like Social Security numbers, bank details, and employment data. Red Flag: Applications that ask for highly sensitive information before you’ve seen the property or met the landlord in person. Genuine landlords typically require detailed information only after a viewing or an initial screening. |

| Phishing Emails and Texts | How It Works: Scammers send emails or texts posing as landlords, property managers, or even well-known rental websites. These messages include links to fake websites that capture your login credentials or personal information. Red Flag: Emails or messages with suspicious links, spelling mistakes, or urgent language asking you to click quickly. Phishing attempts often claim to be from trusted platforms but have slight differences in their website URLs. |

| Requests for Extra Personal Information | How It Works: Scammers might ask for excessive personal information beyond what is typically required for a rental, like your mother’s maiden name, previous bank statements, or even copies of your passport. Red Flag: Requests for additional personal details that seem irrelevant to a rental application. Legitimate landlords don’t typically need extensive personal background information beyond what’s needed for a standard credit and background check. |

| Untraceable Payment Methods | How It Works: Scammers often ask for deposits or application fees via cash transfer apps, wire transfers, or other untraceable payment methods. Once you send the money, it’s nearly impossible to get it back, and they may use your payment info to commit fraud. Red Flag: Requests for untraceable payments, like gift cards, wire transfers, or money orders. Most legitimate landlords will provide secure, trackable payment options. |

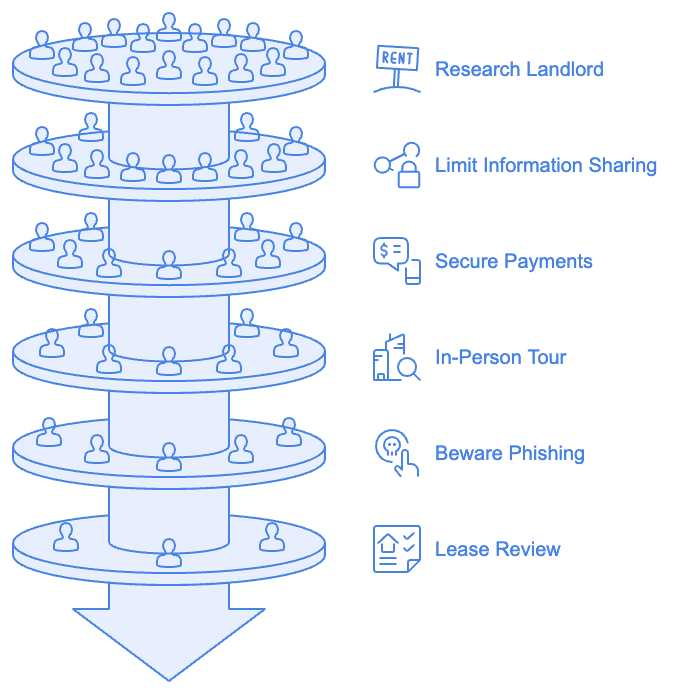

Steps to Protect Yourself from Identity Theft in the Rental Process

Now that you know the common tactics, here are some practical steps to safeguard your information.

1. Research the Landlord or Property Manager

- How It Helps: Verifying the landlord or property management company’s legitimacy can help prevent scams before you even apply.

- How to Do It: Search for the landlord’s or company’s name online and check for reviews on platforms like Yelp, the Better Business Bureau (BBB), or Section 8 Shield’s scam alert page. You can also verify property ownership through local public records.

- Red Flag: A lack of reviews, inconsistent information, or negative reviews mentioning fraud or scams.

2. Limit Sensitive Information Until You’ve Verified Legitimacy

- How It Helps: Limiting the information you provide early on minimizes the risk of identity theft.

- What to Do: Provide only necessary details, like your name and contact information, until you’ve confirmed the property and landlord are legitimate. Save your Social Security number, bank information, and other sensitive data for the final stages of the application process.

- Red Flag: Requests for Social Security numbers or banking information early in the process, especially if you haven’t met the landlord or viewed the property.

3. Use Secure Payment Methods for Fees and Deposits

- How It Helps: Using secure payment methods, like checks or credit cards, adds a layer of protection against fraud.

- What to Do: Avoid untraceable payment methods like cash, wire transfers, or cash apps (e.g., Venmo, Zelle). Stick to methods that provide documentation and fraud protection, like credit cards.

- Red Flag: Demands for payment through untraceable or unusual methods, especially if payment is requested before seeing the property or signing a lease.

4. Request a Live or In-Person Property Tour

- How It Helps: Viewing the property in person or through a live virtual tour can help confirm the listing is legitimate and reduce the chance of dealing with a scammer.

- What to Do: Request a tour of the property, preferably in person. If you’re relocating, ask for a live video tour where the landlord can answer your questions. Avoid sending any personal information until after the tour.

- Red Flag: Refusal to provide a tour or using excuses like being “out of town” to avoid showing the property.

5. Beware of Phishing Attempts

- How It Helps: Recognizing phishing attempts can prevent you from unintentionally sharing login details or personal information.

- What to Do: If you receive an email or text that seems suspicious, check the sender’s email address or phone number closely. Look for odd URLs, spelling errors, or requests to click links without explanation. When in doubt, go directly to the website instead of clicking links in messages.

- Red Flag: Messages that demand immediate action or include strange links, such as misspelled rental website URLs or suspicious email addresses.

6. Check the Lease Agreement Carefully Before Providing Sensitive Information

- How It Helps: Reviewing the lease helps ensure that everything is legitimate before you commit to sharing sensitive details.

- What to Do: Request a copy of the lease before providing your Social Security number or bank details. Make sure the lease includes standard terms and no unexpected clauses.

- Red Flag: Vague or incomplete leases, or landlords who won’t provide a lease until after payment or sensitive information is shared.

7. Use a Credit Monitoring Service

- How It Helps: Credit monitoring services can alert you to suspicious activity, like new accounts opened in your name, which can indicate identity theft.

- What to Do: Consider enrolling in a credit monitoring service, especially after applying for multiple rentals. Many services offer alerts for unusual credit inquiries or new accounts, helping you detect identity theft early.

- Red Flag: Unexpected credit report inquiries or accounts you didn’t open—these can be signs that someone is using your information.

Protecting Your Identity in the Rental Process

Identity theft is a serious risk during the rental application process, especially with the rise of online scams and fake listings. By staying informed and following these protective steps, you can reduce your risk and avoid sharing sensitive information with the wrong people. Section 8 Shield is here to provide resources, tips, and a platform to report scams, ensuring renters have the tools they need for a secure rental experience.

Remember, take your time, verify all details, and prioritize your safety over urgency. With these precautions in place, you can protect your identity while finding the right rental.