Illegal Rent Agreements: How to Recognize and Avoid Them

January 17, 2023

How to Protect Your Personal Information During Rental Applications

March 23, 2023When you’re applying for a rental, it’s essential to stay vigilant. Scammers often target the application process, using it to collect personal information, request bogus fees, or even pose as fake landlords to collect money from multiple applicants. At Section 8 Shield, we’ve looked into how rental application scams work and gathered tips from our readers who’ve dealt with them. This guide will walk you through steps to protect yourself and avoid scams while applying for a rental.

Common Types of Rental Application Scams

Before we dive into protective steps, let’s look at some common types of rental application scams.

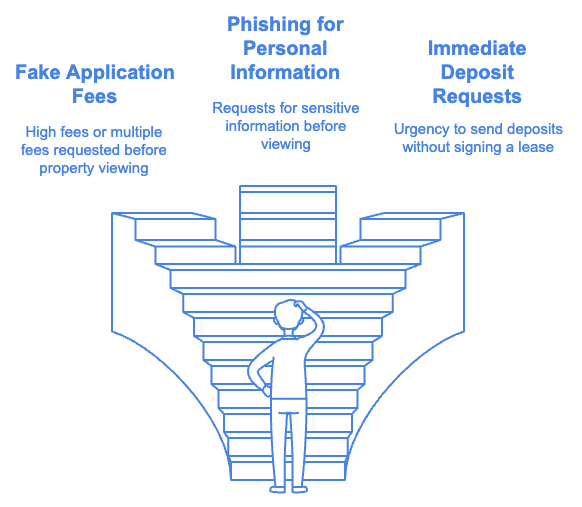

1. Fake Application Fees

- How It Works: Scammers create fake listings, collect application fees from multiple people, and disappear. They may claim high demand for the property to pressure applicants into paying quickly.

- Red Flag: The application fee is unusually high, or the landlord demands multiple fees (e.g., for “background check” and “processing”) before you even see the property.

2. Phishing for Personal Information

- How It Works: Scammers collect sensitive information under the guise of a rental application. They may ask for your Social Security number, bank details, or other data that could lead to identity theft.

- Red Flag: Requests for highly sensitive information, especially before a property viewing, or vague explanations for why they need it.

3. “Pending” Applications with Immediate Deposit Requests

- How It Works: The scammer tells you that you’re approved for the rental but need to send a deposit immediately to secure it. They might claim that other applicants are also interested, creating urgency.

- Red Flag: Pressure to send a deposit before signing a lease or without seeing the property in person.

Steps to Protect Your Rental Application

To help you avoid falling victim to these scams, here are practical steps for scam-proofing your rental application.

| Research the Property and Landlord or Property Manager | How It Helps: Verifying the property and the landlord or property manager’s legitimacy can prevent scams before you even apply. How to Do It: Start by searching online for the property’s address to confirm it’s listed on reputable rental sites like Zillow or Apartments.com. Also, look for reviews of the landlord or property management company on trusted sites like the Better Business Bureau (BBB) or Yelp. Red Flag: If the listing appears only on a free classified site or the landlord/property manager has no online presence, proceed with caution. |

| Request a Property Viewing Before Applying | How It Helps: Viewing the property in person (or via a live virtual tour if you’re relocating) can help confirm that the rental is real and that the person you’re dealing with is the legitimate landlord or agent. What to Do: Insist on a tour before providing personal information or paying any fees. During the tour, ask specific questions about the property and observe the person’s knowledge and behavior. Red Flag: Refusal to show the property or claiming that it’s unavailable for viewing. |

| Understand Standard Application Fees | How It Helps: Knowing the standard application fees for your area can help you recognize when a fee is too high or unnecessary. What to Do: Research typical application fees in your city or state (usually around $30–$50). Legitimate landlords may charge a fee for credit or background checks, but it should be reasonable and transparent. Red Flag: High fees with vague descriptions or multiple charges (e.g., separate “processing” and “background check” fees) are suspicious. |

| Limit Personal Information Provided Early On | How It Helps: Avoiding oversharing protects you from identity theft and data misuse. What to Do: Only share necessary information until you verify the landlord and property. Sensitive information like Social Security numbers or bank details should only be shared after you confirm the legitimacy of the listing. Red Flag: Requests for highly sensitive information early in the application process. Be wary of anyone who asks for more than basic contact details upfront. |

| Verify the Landlord’s Identity | How It Helps: Confirming the landlord’s identity ensures that you’re dealing with the property’s actual owner or a licensed representative. What to Do: Ask for proof of ownership or contact the property management company if one is listed. You can often verify property ownership through county property records, which are usually available online. Red Flag: The person refuses to verify their identity or provide proof of ownership. |

| Use Secure Payment Methods for Application Fees | How It Helps: Using secure payment methods can help you recover funds if you end up in a scam. What to Do: Avoid cash, wire transfers, or payment apps like Venmo or Cash App for application fees. Instead, use a credit card, which offers more fraud protection, or a check. Red Flag: The landlord insists on untraceable payment methods, like wire transfers or cash. |

| Ask for a Copy of the Lease Agreement Before Paying Deposits | How It Helps: Reviewing the lease protects you from false promises or hidden terms. What to Do: Request the lease for review before paying any deposits. Look for standard clauses and make sure the terms are clear and fair. Red Flag: Pressure to pay a deposit without seeing the lease or promises that the lease will come later. |

| Read Reviews and Check for Rental Scams Online | How It Helps: Reading reviews and checking for scam alerts can reveal if others have had negative experiences with the landlord or listing. What to Do: Check the landlord or property management company’s reviews on Google, BBB, Yelp, or Section 8 Shield’s scam alert page. Look for reports of fake listings, unreturned deposits, or poor communication. Red Flag: Multiple reviews mentioning scams or complaints about fees not being returned. |

Additional Tips to Keep Your Rental Application Safe

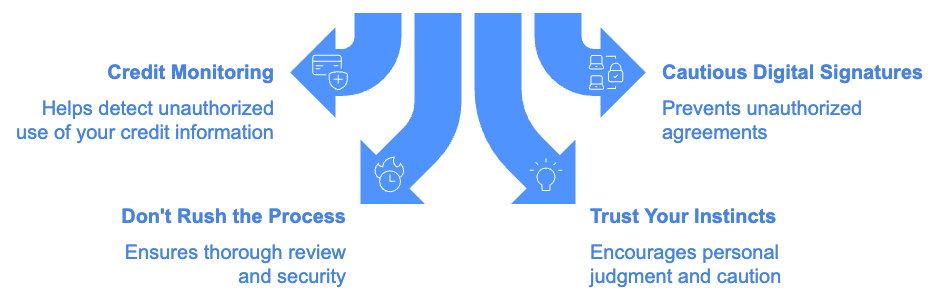

1. Use a Credit Monitoring Service

- Why It’s Important: Scammers who gather your personal information can use it for identity theft. A credit monitoring service alerts you if new accounts or credit inquiries appear in your name.

- Tip: Many credit bureaus offer free credit monitoring, which can alert you if something unusual happens after you apply for a rental.

2. Be Cautious with Digital Signatures

- Why It’s Important: Scammers may try to use a digital signature platform to get you to agree to unexpected terms.

- Tip: Read every document before signing, even if it’s electronic. Make sure it’s a standard rental application or lease and that you’re comfortable with all terms.

3. Don’t Rush the Process

- Why It’s Important: Scammers create a sense of urgency to get you to act quickly and overlook warning signs.

- Tip: Take time to verify details and avoid making impulsive decisions. If you feel rushed or pressured, step back and assess the situation.

4. Trust Your Instincts

- Why It’s Important: Many renters report feeling that “something was off” about the rental application but ignored it. If something feels suspicious, trust your instincts.

- Tip: Look for alternative rentals if you feel uneasy. It’s better to miss out on a listing than fall victim to a scam.

Protecting Your Rental Application from Scams

The rental application process is a vulnerable time for renters, as scammers can easily blend into online listings and mimic legitimate landlords. By following these steps, you can make your application process more secure, ensuring your personal information and money stay safe. Section 8 Shield is here to guide you through these precautions, helping you find a secure, scam-free rental experience.

Take your time, verify all details, and don’t let pressure or urgency cloud your judgment. With these protections in place, you can confidently apply for rentals and avoid falling into common scam traps.