Fake Rental Agencies: How to Spot and Avoid Them

February 15, 2022

Is My Landlord Scamming Me? What I Learned the Hard Way

April 15, 2022Navigating the world of renting can be tricky, especially when scammers target potential tenants through fake application fees. Scammers often pose as landlords or rental agents to collect fees without any intention of renting out a property. Understanding these scams and how to avoid them is essential for anyone looking for affordable housing.

How Application Fee Scams Work

Application fee scams are common and can look legitimate. Here’s how they typically operate:

- Fake Listings: Scammers post attractive rental listings online, often with below-market prices and appealing photos. These listings may appear on trusted platforms, making them seem more credible.

- Urgent Requests: The scammer pressures you to act quickly by saying other people are interested in the property. This urgency is used to push victims into paying without due diligence.

- Upfront Fees: The scammer requests an application fee or even a security deposit upfront. They might promise that paying quickly will secure your application or spot on the property’s waiting list.

- Communication Red Flags: Scammers often prefer to communicate only via email or messaging apps, avoiding face-to-face interaction. This distance helps them stay anonymous.

Common Signs of a Scam

Recognizing a rental scam before falling victim is critical. Here are common red flags:

| No In-Person Interaction | The landlord refuses to meet or show the property in person. |

| Requests for Wire Transfers | Legitimate landlords usually don’t ask for payment through wire transfers or prepaid debit cards. |

| Vague Details | The listing might lack basic information, or the person you’re communicating with avoids answering detailed questions about the property. |

| Non-Professional Emails | Poorly written emails, mismatched email addresses, or general terms like “Dear renter” instead of using your name are warning signs. |

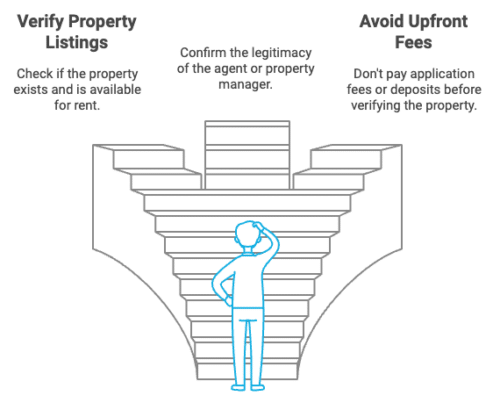

Tips to Protect Yourself

To stay safe and avoid being scammed, consider these strategies:

- Research the Listing:

- Search for the property’s address online to see if it is listed elsewhere or marked as fraudulent.

- Cross-check the landlord’s name and phone number for any reports of scams.

- Verify the Landlord:

- Ask for the landlord’s name and contact information. Verify their ownership of the property through local property records or public databases.

- Never Pay Upfront:

- Avoid making any payment before seeing the property and signing a legitimate rental agreement.

- Be cautious of paying fees through untraceable methods like cash apps or gift cards.

- Visit the Property:

- Arrange a viewing before committing to anything. If the landlord is unavailable for an in-person visit or even a virtual tour, this could be a scam.

- Use Trusted Websites:

- Stick to well-known rental platforms that have verified listings. Beware of listings that seem too good to be true or are found on less popular sites.

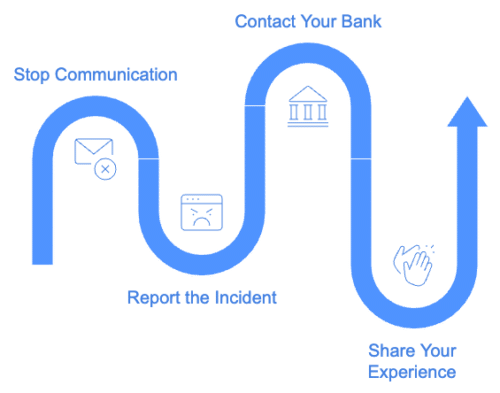

What to Do If You’ve Been Scammed

If you suspect you’ve fallen victim to an application fee scam, take immediate action:

- Stop Communication: Cut off all contact with the scammer to avoid further loss.

- Report the Incident: Report the scam to local authorities, consumer protection services, or housing scam watchdogs such as the Federal Trade Commission (FTC).

- Contact Your Bank: If you made any payment, notify your bank or credit card company to try and reverse the charges.

- Share Your Experience: Warn others by reporting your experience to consumer protection platforms like the Better Business Bureau (BBB) or scam reporting sites.

Reliable Resources for Renters

To stay informed and safe, use these trusted sources:

- Section 8 Shield: This dedicated platform that you are using provides guidance, tools, and resources to verify housing websites, report scams, and stay informed about common rental frauds.

- HUD (U.S. Department of Housing and Urban Development): Provides official guidance on rental assistance and avoiding scams.

- BBB Scam Tracker: Helps identify and report scams.

- Consumer Financial Protection Bureau (CFPB): Offers resources and guidance for consumers who have encountered fraud.

- ScamWatchers and Fraud.org: Useful platforms for sharing experiences and learning about ongoing scams.

Additional Safety Practices

- Be Skeptical of Pressure Tactics: A legitimate landlord will not rush you into decisions. If a rental ad insists you send money immediately to “hold” the property, be wary.

- Check the Paperwork: Always review lease agreements in detail. Ensure they align with standard practices in your area, such as the right to review before signing.

- Look for Reviews: Search for reviews or reports about the landlord or property management company. Scam artists often recycle the same tactics, so reports can reveal if others have been targeted.

Real Stories from Victims

Many renters have shared their experiences, detailing how application fee scams impacted them. Common themes include:

- Fake Promises: Victims often paid application fees for properties that either didn’t exist or were not available.

- Fraudulent Agents: Some impersonated legitimate agents or property managers, using falsified documents and professional websites.

- Loss of Funds: Victims frequently report losing substantial sums, ranging from application fees to larger security deposits.

Taking Preventative Action

To avoid falling into such traps:

- Keep Records: Always document your interactions and keep copies of any correspondence and payment receipts.

- Talk to Previous Tenants: If possible, speak to current or former tenants to confirm the legitimacy of the property.

- Search for Duplicates: Scammers may use the same property listing on different sites. If you find duplicates with different contact details, it’s a red flag.

Avoiding application fee scams requires vigilance and informed decision-making. Use these guidelines and resources to protect yourself and navigate the rental process safely.